Standard Chartered Backs ChinaAMC’s First Tokenised Retail Fund

13 February 2025, Hong Kong – Standard Chartered Bank (Hong Kong) Limited is pleased to announce that it is supporting China Asset Management (Hong Kong) Limited (“ChinaAMC (HK)”) to launch the first tokenised retail money market fund in Asia Pacific tentatively by the end of February as its digital asset service provider, with Standard Chartered […]

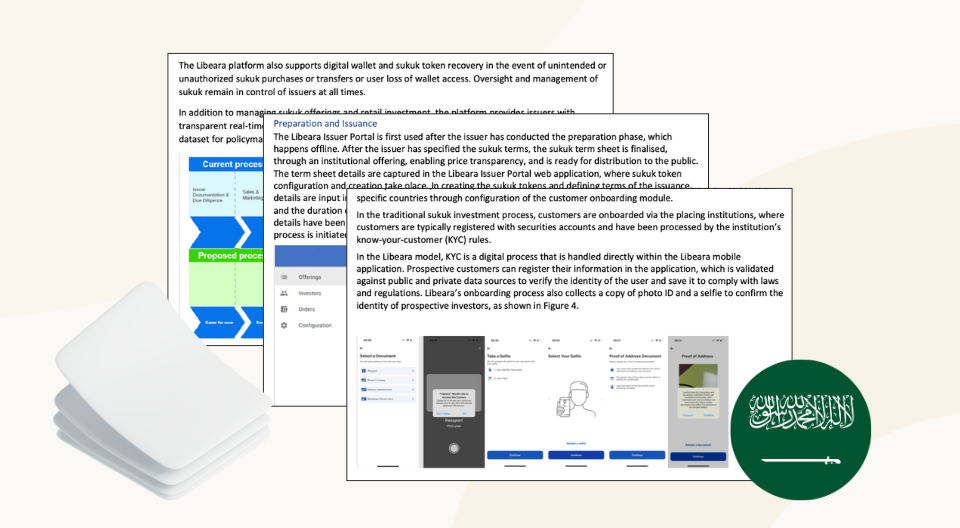

Digital Government Sukuk in the Kingdom of Saudi Arabia: Libeara Whitepaper

Successful Ghanaian Government Bond Test Exercise

On February 2023, Libeara conducted a test exercise to replicate the real bond lifecycle of Ghanaian government bonds, involving everything from creation to retail investor onboarding, account creation, and an entire slew of transactions both within the Libeara platform and with Ghanaian Mobile Money wallets. Participants included employees of Standard Chartered Bank (“SCB”) Ghana, SCVentures, […]

Project Genesis with HKMA and Bank of International Settlements

A Libeara prototype was developed as part of Project Genesis in collaboration with the Hong Kong Monetary Authority (HKMA) and Bank of International Settlements (BIS), the latter’s first green finance project exploring new opportunities in green bond tokenisation. On top of improving investor participation by streamlining the bond issuance and lifecycle processes, the project also […]

Finalist for MAS Global Retail Central Bank Digital Currency (CBDC) Challenge

The Libeara solution received international-level endorsement when SCB presented their tokenisation solution and emerged as one of the 15 finalists out of over 300 international participants in the Monetary Authority of Singapore’s (MAS) Global Central Bank Digital Currency (CBDC) Challenge. Finalists were selected by an independent panel of judges comprising policy and technical experts, academia, […]

First Tokenised Retail Bond in the Philippines

Libeara’s tokenisation technology facilitated the digital tokenisation of retail bonds between Union Bank of the Philippines (UnionBank) and Standard Chartered Bank (SCB). In total, PHP 9 billion worth of bonds with 3 and 5.25-year dual tranche were issued on public ledger. While the tokens issued mirrored traditional transactions, they were not allocated directly to investors. […]